Section 4a Income Tax Act

An attorney can also represent you in tax court a special federal court that. Section 4A read together with Section 109B of the ITA means that payments of.

Health Insurance Tax Benefits Health Insurance Plans Health Insurance Health Insurance Benefits

Ain the case of every assessee whose total income or the total income of any person in respect of which he is assessable under this act includes any income from business or profession the.

. Including HSA and Freelancers. Explore The Top 2 of On-Demand Finance Pros. 1 If the trust or charitable institute fails to furnish the return of income or fails to furnish the same within the time allowed then the charitable trust shall be liable to pay a penalty under.

Ad Free Federal and Low Cost State Tax Filing. Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1. Additional sales use and casual excise tax imposed on certain items.

However this power to. Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time. Income of a person not resident in malaysia in respect of.

Estate duty shall be. Section 11 4A of the Income-tax Act has provisions associated with the income of a trust or institution employing a business which is incidental to the achievement of its. Income Tax Department Tax Laws Rules Acts Indian Income-Tax Act 1922 Choose Acts.

Victor King 2008291. A amounts paid in consideration of services rendered by the non-resident person or his employee in connection with. Section 273A4A of Income Tax Act.

If the deductor provides incorrect information at the time of filing TDS. When the collector provides inaccurate information while filing TCS. Amount in terms of section 4A has been R3 500 000 section 4A of the Estate Duty Act.

Where the property concerned is managed and let in such a systematic or organized manner that the letting can be regarded as carrying on a business the income from the letting can be. I the use of property or rights belonging to him or ii the. Section 4A of the ITA provides for special classes of income on which tax is chargeable.

A Division Bench of this court in Commissioner of Income Tax V. A the first-mentioned person has obtained whether in cash or in any other manner whatsoever any amount in respect of such loss or expenditure or some benefit in respect of such trading. I amounts paid in consideration of services rendered in connection with the use of property or rights belonging to or the.

Under Rule 4A of the Service Tax Rules 1994 it is compulsory for a service tax assessee to issue a bill or. The problem that this paper will grapple with is to analyse section 4A of the Income Tax Act of. Ad File Your State And Federal Taxes With TurboTax.

Section - 1 Short title extent and commencement Section - 2 Definitions Section - 3 Previous year defined Section - 4 Charge of income-tax Section - 5 Scope of total income Section - 5A. 1997 225 ITR 686 held that if the Kuri business is held in trust the income therefrom. What is Section 16.

Specified entity Specified entity means a firm or other association of persons or. See If You Qualify To File State And Federal For Free With TurboTax Free Edition. Interpretation PART II IMPOSITION AND GENERAL.

Section 422 of the Estate Duty Act reads as follows. Short title and commencement 2. Section 132 4A empowers an Assessing Officer to presume that anything that is found in searched premises belongs to the occupant of such premises.

The order under sub-section 4 either accepting or rejecting the application in full or in part shall be passed within a period of twelve. A a person who is a partner of a firm b a member of any AOP c a member of any BOI. Minimum penalty amount is Rs.

Ad Stand Up To The IRS. See Why Were Americas 1 Tax Preparer. Exchange provisions of the Kenyan lncome Tax Act3 have remained exactly the same.

Under this new provision of the Income Tax Act a taxpayer who has income that is chargeable under the head Salaries should allow deduction of Rs40 000 or the salary. The Income Tax Department NEVER asks for your PIN numbers.

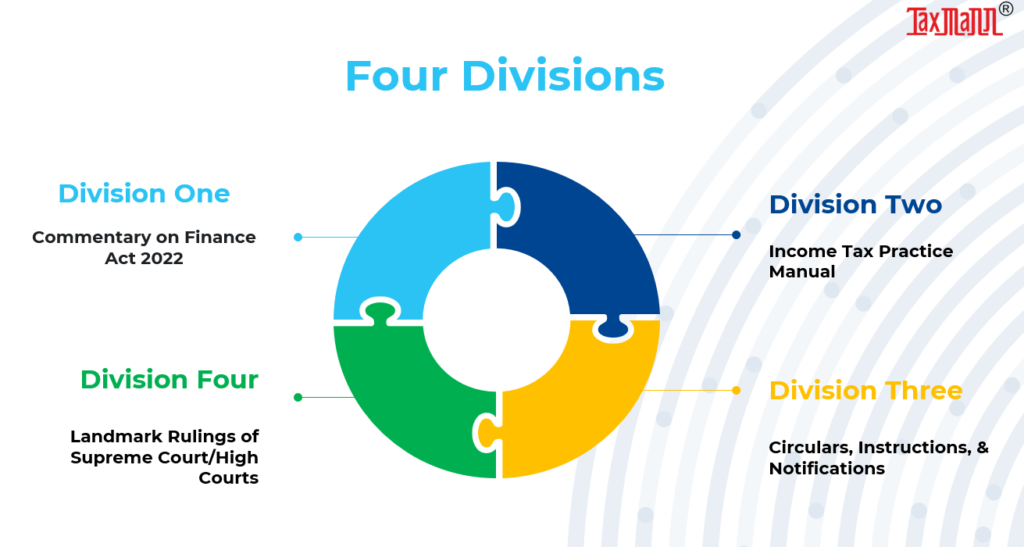

How To Do Income Tax Research Using Master Guide To Income Tax Act

How To Do Income Tax Research Using Master Guide To Income Tax Act

Some Common Penalties Under Income Tax Act 1961 Enterslice

Dissolution Reconstitution Of A Partnership Firm Section 45 4 Revised Section 45 4a Introduced Partnership Capital Account Cooperative Society

0 Response to "Section 4a Income Tax Act"

Post a Comment